The main reason to use fund structure is to increase your leverage and tax efficiency enabling you to maximize your return from the assets. However, structuring fund requires certain costs and labour, so it is more suitable for higher-priced properties.

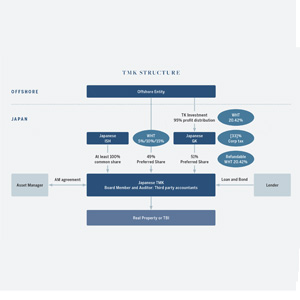

TMK and GK-TK are two most commonly-used fund structures for Real Estate Investment in Japan.

This issue, we handpicked the selections where the afore-mentioned fund structure can be arranged while some are already under the structure.

SELECTIONS SUITABLE FOR FUND STRUCTURE

Eye catching SOHO en bloc along Meiji Dori

Hiroo, Shibuya-ku, Tokyo 東京.澀谷區.廣尾

Property ID: 8663

Type: Residential & Retail

Land Area: 162 sqm (1,744 sqft)

Total GFA: 1,031 sqm (11,095 sqft)

Estimated Rental Revenue: JPY 51m

Estimated Return: 3.65% (probability to increase over 4%)

Price (Incl c-tax): JPY 1.29b (USD 12m approx.)

Fully refurbished office en bloc in Nihonbashi with potential return of 5.1%

Nihonbashi, Chuo-ku, Tokyo 東京.中央區.日本橋

Property ID: 8664

Type: Office

Land Area: 225 sqm (2,424 sqft)

Total GFA: 1,327 sqm (1,327 sqft)

Estimated Rental Revenue: JPY 87m

Estimated Return: 5.12%

Price (Incl c-tax): JPY 1.7b (USD 15.8m approx.)

Brand new residential with master lease option in Kagurazaka

Tansumachi, Chuo-ku, Tokyo 東京.中央區.神樂坂

Property ID: 8657

Type: Residential

Land Area: 219 sqm (2,353 sqft)

Total GFA: 997 sqm (10,727 sqft)

Estimated Rental Revenue: JPY 48m

Estimated Return: 4.16%

Price (Incl c-tax): JPY 1.1853b (USD 11m approx.)

SELECTIONS ALREADY UNDER STRUCTURE

Fully-leased residential en bloc with cash on cash, walking distance to Ginza

Tsukiji, Chuo-ku, Tokyo 東京.中央區.築地

Property ID: 8658

Type: Residential

Land Area: 246 sqm (2,643 sqft)

Total GFA: 1,504 sqm (16,191 sqft)

Estimated Rental Revenue: JPY 65m

Estimated Return: 3.8% (Uplift potential) / 6% (TK share transfer)

Price (Excl c-tax): JPY 1.8b (USD 16.76m approx.)

Decent sized office en bloc with an anchor tenant, 1-min from the metro

Hatsudai, Shibuya-ku, Tokyo 東京.澀谷區.初台

Property ID: 8665

Type: Office

Land Area: 960 sqm (10,338 sqft)

Total GFA: 5,287 sqm (56,914 sqft)

Estimated Rental Revenue: JPY 284m

Estimated Return: 5.12%

Price Upon Request

Office en bloc with upside potential in Shibuya

Hatagaya, Shibuya-ku, Tokyo 東京.中央區.幡谷

Property ID: 8661

Type: Office & car parking space

Land Area: 585 sqm (6,297 sqft)

Total GFA: 2,995 sqm (32,237 sqft)

Estimated Rental Revenue: JPY 107m

Estimated Return: 5%

Price (Excl c-tax): JPY 2.1b (USD 19.6m approx.)

If you would like to get to know more, feel free to reach out to us for private consultation.

Mayumi Lambon (E-308403)

+852 9109 1526 MayumiL@listsirhk.com