The main reason to use fund structure is to increase your leverage and tax efficiency enabling you to maximize your return from the assets. However, structuring fund requires certain costs and labour, so it is more suitable for higher-priced properties.

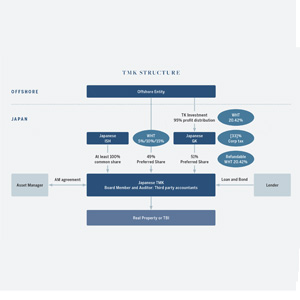

TMK and GK-TK are two most commonly-used fund structures for Real Estate Investment in Japan.

This issue, we handpicked the selections where the afore-mentioned fund structure can be arranged while some are already under the structure.

READ MORE